RNS Number: 4524Q

ACG Metals Limited

27 January 2026

ACG Metals Limited announces that its Remuneration Committee (“RemCo”) approved the issuance and/or vesting of certain awards under its value creation plan (“VCP”) and employee incentive plan (“EIP”) on 23 January 2026. The VCP and EIP were established on the readmission of the Company’s shares to trading on the London Stock Exchange (“Readmission”) following completion of the acquisition of the Gediktepe mine in September 2024 and are designed to incentivise the Company’s management team and other senior employees to deliver exceptional returns for shareholders.

In deciding to grant its approval, RemCo took into account a number of important factors, including the following:

- The VCP and EIP were approved by the Company’s board of directors at Readmission and fully disclosed in the Prospectus published by the Company on 7 August 2024 (the “Prospectus”).

- The Company’s share price increased from US$6 at the commencement of the first measurement period in respect of the VCP to US$15.06 at the end of this period.

- As a result, the Company’s overall market capitalisation increased from US$104,939,478 to US $343,283,661 during the same period.

Amendments to certain terms of the VCP and EIP

Prior to granting this approval, RemCo approved certain adjustments to the measurement periods for the VCP and vesting dates for the EIP Awards (as defined below) to align them with the Company’s financial year. In consequence:

- The first measurement date in respect of the VCP has been brought forward from 16 October 2026 to 31 December 2025, with subsequent measurement dates now scheduled to fall on 31 December 2026 (the “Second Measurement Date“), 31 December 2027 (the “Third Measurement Date“) and 31 December 2028 (the “Fourth Measurement Date“).

- The first vesting date in respect of the EIP Awards has been postponed from 16 October 2025 to 31 December 2025, with subsequent vesting dates now scheduled to fall on 31 December 2026 and 31 December 2027.

All other terms of the VCP and EIP (as further detailed in the Prospectus) remain unchanged.

Awards under the VCP and EIP

Pursuant to the VCP, the recipients may elect to receive these awards either in class A ordinary shares in the Company (“Shares”) or options over Shares (“Options”). The following awards (“Initial VCP Awards”) have been approved in respect of the first measurement period under the VCP:

- Mr Artem Volynets (CEO) 756,246 Shares

- Mr Patrick Henze (CFO) 604,997 Options

- Mr. Peter Carter (COO) 75,625 Shares

- Mr. Damien Coles (CLO) 75,625 Options

Only one third of the Initial VCP Awards will vest immediately, with the remainder vesting (along with any future VCP awards (together with the Initial VCP Awards, the “VCP Awards“) over a four-year period as follows:

- 50% of the unvested VCP Awards are scheduled to vest on the Second Measurement Date.

- 50% of the unvested VCP Awards are scheduled to vest on the Third Measurement Date.

- The remaining unvested VCP Awards are scheduled to vest on the Fourth Measurement Date.

Vesting of all unvested VCP Awards is subject to malusand clawback.

RemCo also approved the issuance of an aggregate of 12,665 Shares to other key employees under the EIP and in accordance with the terms of their employment contracts. Once again, recipients may elect to receive these awards in either Shares or Options.

Vesting of Shares and Options

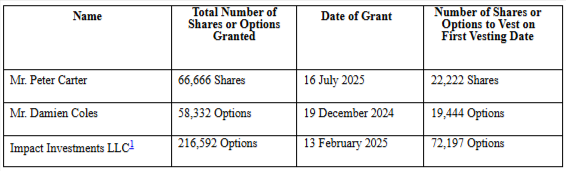

In addition, RemCo approved the vesting of the first tranches of Shares or Options previously issued pursuant to one-off performance awards (the “EIP Awards”) under the EIP, which are scheduled to vest in equal portions over a three-year period.

Following the Initial VCP Awards and vesting of the first tranches of Shares under the EIP Awards, the interests of the directors in the share capital of the Company will remain unchanged, save that the number of Shares held by Mr. Artem Volynets (through his personal services company, ACG Advisory Limited) will (assuming all Initial ACP Award Shares vest) increase to 1,307,567.

Application will be made for the new Shares to be listed on the equity shares (transition category) of the Official List of the Financial Conduct Authority and to trading on the London Stock Exchange and a further announcement confirming such admission will be made in due course.

1 Note: Michael Pompeo is the executive chairman of Investments LLC.