RNS Number: 3611P

ACG Metals Limited

19 January 2026

ACG Metals Limited is pleased to announce its operations update for the fourth quarter of 2025 (“Q4 2025”) and the full 2025 financial year (“FY 2025”).

Artem Volynets (Chairman and CEO) and Patrick Henze (CFO) will provide a live presentation via Investor Meet Company on 26 Jan 2026, 12:00 GMT. To attend, investors can join via this link: https://www.investormeetcompany.com/acg-metals-limited/register-investor

The Company finished the year with an LTIF of 0.66 including 1.6 M man-hours worked LTI-free.

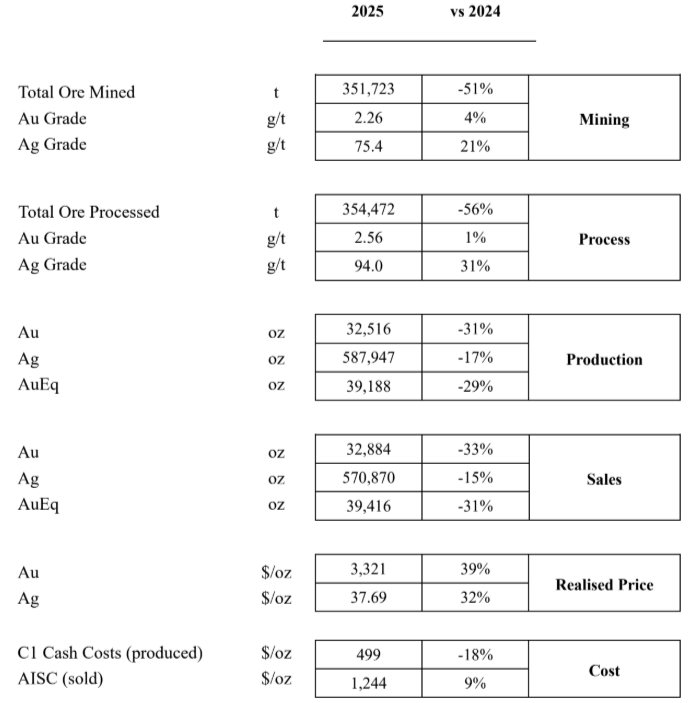

ACG delivered a strong finish to 2025, exceeding production guidance with 39.2 koz AuEq produced (3% over the top end) and 39.5 koz AuEq sold during the Gediktepe mine’s first full year under ACG’s ownership. Operational efficiency and cost controls drove a 18% reduction in C1 cash costs to US$499/oz AuEq. AISC increased to US$1,244/oz AuEq from US$1,139 year‐on‐year, driven by the increases in gold and silver prices, resulting in higher royalty payments.

The Company is pleased to announce its 2026 production and AISC guidance at 20 – 22 ktpa CuEq production, including the 17.5 koz AuEq of oxide production stacked and presently under leach. AISC are expected to be at approximately US$2.40 – US$2.60/lb CuEq in this transformational year for ACG Metals. The oxide production cost will significantly benefit from the reduced royalty rate with EMX Royalty Corporation (2.25% this year vs 10% last year).

The Gediktepe Sulphide Expansion Project advanced significantly during the year and is on time and on budget for commercial production by the end of H1 2026, transitioning ACG into a copper producer.

The Enriched Ore Treatment Project at Gediktepe mine is targeting an additional c.57kt CuEq from enriched ore and stockpiles on site over a four-year period. In Q4 2025 the Company completed a scoping study and basic engineering. Permitting, metallurgical test works, and

detailed engineering will commence in Q1 2026.

ACG’s net debt as of December 31, 2025 was US$65 million.

Artem Volynets, Chairman and CEO of ACG, said:

“We are proud for our consistent outperformance last year, demonstrating exceptional operating capabilities of our team.

ACG is well positioned to complete transition to copper producer this year with Sulphide Project construction on budget and on time while continuing to strongly benefit from the production of gold and silver from the residual oxide ore.

We are making a great progress on our strategy to establish ACG Metals as a leading growth copper company on the LSE.”

FY 2025 Operating Summary

Safety And Sustainability

Safety culture continued to strengthen in 2025. The Company finished the year with an LTIF of 0.66. This included one lost-time incident sustained by a contract employee for a total of 1.6 M man-hours worked. Efforts remain focused on improving contractor workplace safety as the construction workforce peaks in H1 2026.

Progress continued to position ACG for superior ESG performance. The inaugural annual Sustainability Report nears completion and will be published with the annual report in April. The Company also anticipates completing a comprehensive compliance review in Q1 2026, including updating existing and introducing certain new compliance policies, consistent with its commitment to ensure the highest standards of corporate governance.

Oxide Operation

- FY2025 total ore mined was 351,723 tonnes, down 51% from 2024, reflecting natural sequencing of the mine and production plan.

- Average grades improved, with gold at 2.26 g/t (+4%) and silver at 75.4 g/t (+21%), supporting higher-value ore delivery.

- Ore processed totalled 354,472 tonnes, a 56% decrease year-on-year, as oxide stockpiles were drawn down ahead of sulphide expansion.

- Processing grades strengthened further, with gold at 2.56 g/t (+1%) and silver at 94.0 g/t (+31%).

- Operational efficiency throughout 2025 delivered a 25% reduction in C1 cash costs, decreasing from US$606/oz AuEq to US$455/oz AuEq.

- FY2025 AISC remained broadly stable at US$1,133/oz AuEq, down 1% year-on-year, as higher price-linked royalties offset the benefits of lower operating costs during a period of stronger metal prices.

Gediktepe Sulphide Expansion Advancing at Pace

The Gediktepe Sulphide Expansion Project delivered significant progress in Q4 2025, achieving key construction and equipment milestones while remaining firmly aligned with its development schedule.

- Primary crusher foundations completed, structural steel erected, and major components installed including the jaw crusher, ROM feed bin and feeders.

- Ball and SAG mill foundations finalised, with structural steel erection for the mill building underway.

- Flotation and filter building foundations completed, and earthworks for the tailings storage facility progressing on schedule.

- All flotation tanks, scavenger cells and cleaner cells delivered to site, alongside 1,300 tonnes of structural steel out of the planned 1,700 tonnes.

- SAG and ball mills completed and ready for factory testing by year-end 2025, with rubber lining and delivery scheduled for January 2026.

As of 31 December 2025, the project remained firmly on schedule with engineering 68% complete, procurement 66%, construction 37%, concrete poured 86%, and 80% of long-lead items delivered. The Gediktepe Sulphide Expansion Project remains on track for commercial

production by the end of H1 2026.

Enriched Ore Treatment

ACG successfully delivered on its commitment to identify a method of unlocking potential value from enriched ore and stockpiles at Gediktepe. The company completed a scoping study and basic engineering in 2025. Commissioning for Phase 1 gold and silver recovery is planned for Q4 2026.

In 2028, Phase 2 will commence recovering copper and zinc in addition to precious metals. The project is expected to unlock an additional c.57kt CuEq over 4 years.

Capital Structure Highlights

ACG’s net debt as of December 31, 2025 was US$65 million and a cash balance of $144 million (including a restricted balance of $46 million, and $43 million sulphide cash balance).

Post 2025 year-end, the January 2026 coupon in respect of the US$200 million Nordic bonds issued by ACG Holdco 1 Limited has been paid in full, and the group is in full compliance with its bond terms.